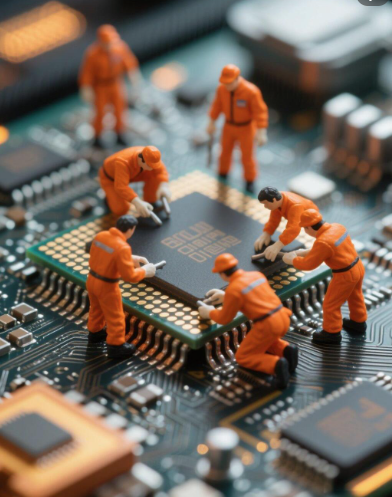

Why the Electronic Component Industry is Stronger Than It Looks

In short: yes, supply chains are shifting, but the broader industry remains fundamentally robust, and working with the right suppliers makes all the difference.

The Big Picture: Growth with Structure

"Volatility" Isn't a Dirty Word-It's a Signal

Now to the part that raises eyebrows: yes, there's volatility. But that isn't necessarily bad-it's a signal to act, vary your strategy, and lean into trusted relationships.

Why Trusted Suppliers Matter More Than Ever

Given all this, here are the key reasons why working with trusted suppliers makes strategic sense now:

- Continuity & commitment – Some memory lines once labeled for "long-term availability" are now being deprecated sooner than expected. Ensuring a supplier follows through on commitments is vital. (For legacy markets like automotive or medical, where requalification is costly, this is especially true.)

- Transparency – A trusted supplier will communicate early when lead-times lengthen, quotes change, allocations shift or EOL decisions loom. This gives your team time to respond.

- Flexibility – When supply and pricing are shifting, you need a partner who can pivot: offering alternate parts, multi-source options, and stock-buffer strategies.

- Quality & risk mitigation – In unpredictable times, quality control, counter-part health (stable manufacturing base) and supply-chain integrity matter a lot. A trusted supplier reduces the risk of surprises.

- Strategic insight – A supplier with market visibility (for pricing, wafer capacity, allocation trends) becomes a partner in mission-critical planning, not just a "vendor".

- By building sourcing relationships around trust, transparency and shared strategic awareness, you position yourself not just for reaction-but for proactive leadership in your component-strategy.

Turning Change into Advantage

So how can procurement/design teams turn the current turbulence into advantage? Here are some practical moves:

- Diversify your sourcing: don't rely on a single supplier for critical parts.

- Be selective about "last-time buys": when a part's being discontinued or legacy-technology capacity is shrinking, you might make a buy-but balance the risk of excess inventory.

- Monitor early indicators: things like wafer-price increases, suspended quotations, shifting allocations are early signs of supply disruption. Being alert gives you lead time.

- Question the "longevity" language: when a supplier states a product is "designed for long-term availability," seek clarity-what's the commitment? What's the risk of EOL?

- Align design and sourcing around stability: especially in automotive, industrial and medical sectors, where product life spans are long and changes are costly.

An Outlook for the Future

Despite the challenges, the long-term view is quite bright. Why? Because innovation is accelerating. More data-centres, more AI applications, more embedded compute. That means more demand for memory, logic, sensors, power management-everything in the electronics-component ecosystem.

For example: a recent report projected the semiconductor market for robots-covering compute, memory, sensors, power ICs-to reach USD 41.24 billion by 2030 (on a ~30 % CAGR) in just that subdomain alone. MarketsandMarkets

What that means is: component-makers and their distributors who stay aligned with design trends, supply-chain shifts and trusted sourcing models are in a sweet spot. The game isn't just about surviving volatility; it's about capitalizing on the structural trend of digitalization, automation and AI.